.jpg)

- #VENMO TRANSACTION LIMIT ANDROID#

- #VENMO TRANSACTION LIMIT CODE#

Fees ranging from 50 cents to 2.3% for buying and selling cryptocurrencies.A 1.5% fee (minimum 25 cents, maximum $15) for instantly transferring money from your Venmo account to your eligible linked debit card or bank account.A 5% fee (with a $5 minimum) for using the check-cashing feature for faster deposits of non-payroll and non-government checks.A 1% fee (with a $5 minimum) for using the check-cashing feature for faster deposits of payroll and government checks.A 3% fee when you use your credit card to send money to someone.However, Venmo charges for some premium features and other services. Making a standard transfer to your linked bank account.Accepting money that goes into your Venmo account or withdrawing money from the account.Sending money from a linked bank account, a linked debit card or your Venmo account.Furthermore, it doesn’t charge for basic services such as: Venmo doesn’t hit customers with monthly or annual fees. bank account, credit card or debit card to initiate payments exceeding your Venmo balance. If you have access to a Venmo account with a balance, you must add a U.S. bank account, credit card or debit card to initiate payments. If you don’t have access to a balance in a Venmo account, you must add a U.S. bank account or a debit card that can be used for instant transfers of money. If you want to transfer money from your Venmo account to your bank account, you need to have a U.S. Be at least 18 years old (in most cases).cell phone that can send and receive text messages using short codes in the U.S., short codes are five- or six-digit numbers for texting Venmo has three main requirements for using the app.

#VENMO TRANSACTION LIMIT ANDROID#

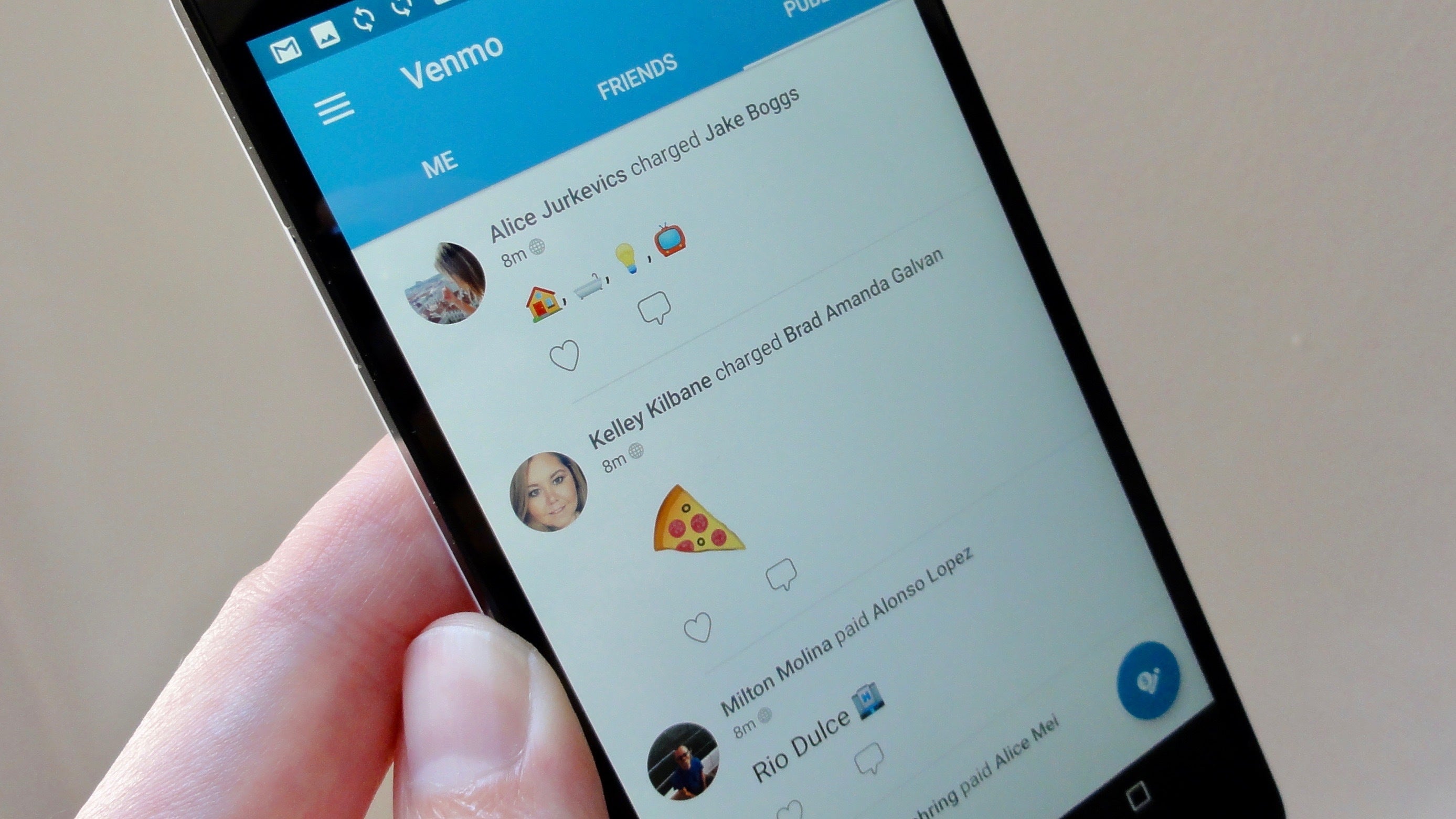

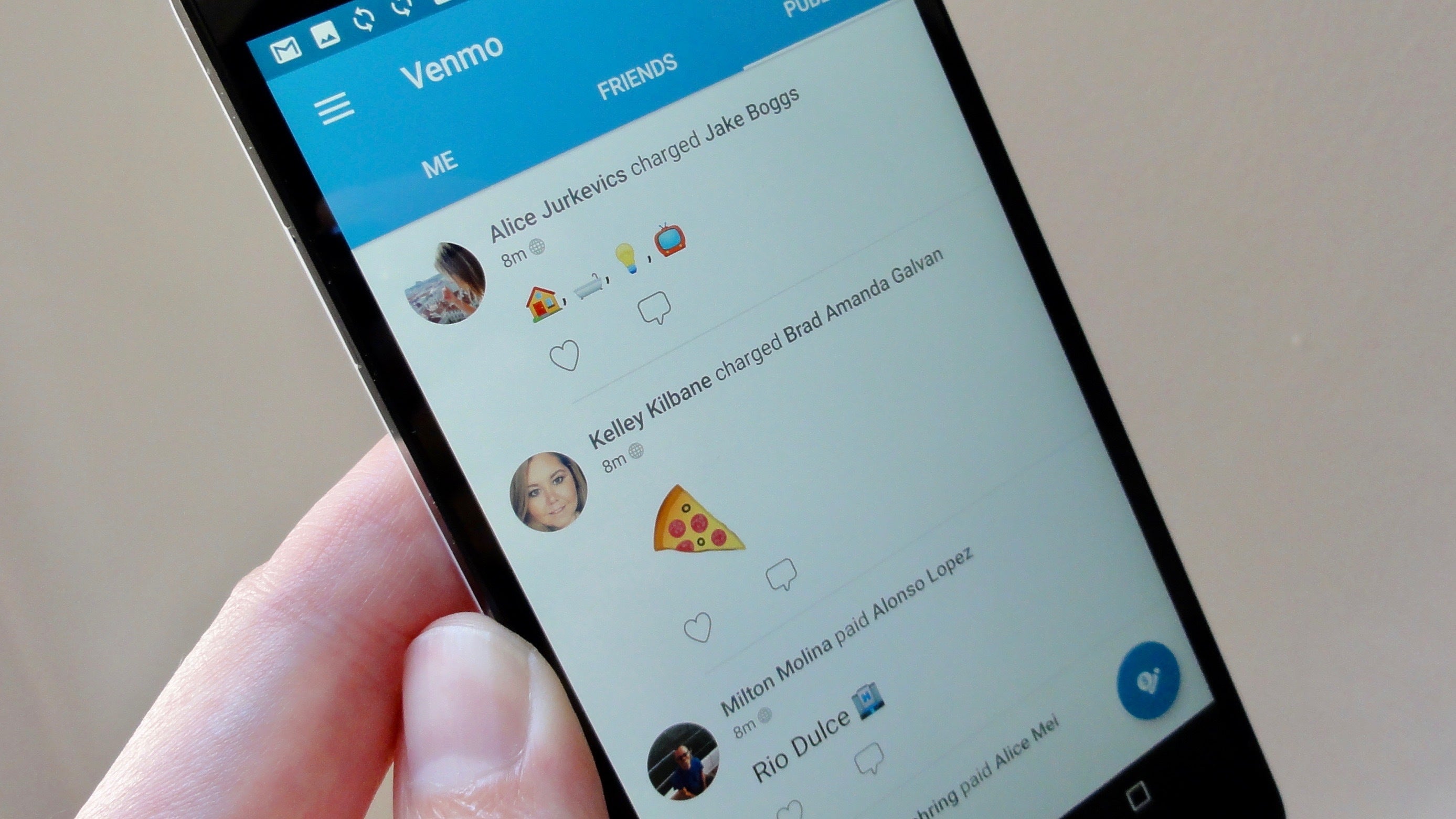

Venmo’s app works on iOS and Android devices. Receive price alerts about four types of cryptocurrency (Bitcoin, Ethereum, Litecoin and Bitcoin Cash) that you can buy, sell or hold through Venmo.Sign up for direct deposit for your paycheck to go straight to your Venmo account, up to two days earlier than your usual payday.

Cash certain checks after you’ve verified your identity by applying for a Venmo debit card or setting up direct deposit.

Cash certain checks after you’ve verified your identity by applying for a Venmo debit card or setting up direct deposit. #VENMO TRANSACTION LIMIT CODE#

Use an in-store QR code to make a purchase with Venmo. Pay for purchases through apps and mobile websites from authorized Venmo partners. Make purchases with Venmo’s Mastercard debit card anywhere in the U.S. Venmo’s functionality goes beyond that, though. For instance, you can use Venmo to split a dinner tab with a coworker, pay for your portion of a taxi ride you shared with your aunt or send your half of the monthly rent to your roommate. Venmo retains sole discretion to apply and change limits.At its heart, Venmo is a cash-free way of sending and receiving money. Limits are subject to periodic review and may be changed based on your Venmo Account history, activity, and other factors, including but not limited to, your Venmo Mastercard Debit Card activity. For example, if you initiate a standard bank transfer on a Monday at 11:00 AM, that transfer will no longer count against your limit at 11:01 AM the following Monday. This means that a transaction counts against a limit for exactly one week from the time of authorization. Most transaction limits on your account are rolling weekly limits. It’s important to remember that these types of transfers can be declined for reasons other than the limits. Instant Add Money has a separate limit of $500 per week. You may be able to add up to $10,000 per week using Standard Add Funds (depending on security checks at Venmo). Some Venmo users have the option to add money to their Venmo account, though this isn’t required to make payments on Venmo. Transfers can be declined for reasons other than the limit. If you are using instant transfer, you’ll need to make a transfer of at least $0.26 – you can’t transfer less than $0.25 using instant transfer. If you want to transfer more than $5,000, you’ll need to initiate multiple transfers. If you’ve confirmed your identity, you can transfer up to $19,999.99 to your bank per week. If you have not yet completed identity verification, you can send up to $999.99 to your bank per week (depending on security checks at Venmo). There are a few limits for moving money from Venmo to your bank account:

Learn about limits for moving money in and out of your personal Venmo account.

.jpg)

0 kommentar(er)

0 kommentar(er)